A Medicare Advantage plan is one of the most popular ways older adults receive their Medicare coverage—and for good reason. These plans often bundle together hospital, medical, and drug benefits, and they may include extras like dental, vision, or transportation services. For many people, simplicity makes managing healthcare easier.

Still, there are details to sort out. How does a Medicare Advantage plan actually work? What does it cover that Original Medicare doesn’t? And how do you decide which plan is right for you?

This guide answers those questions and explains what to look for before you enroll.

What Is a Medicare Advantage Plan?

Also called Medicare Part C, Medicare Advantage plans are provided by private insurers that contract with Medicare. They cover everything included in Original Medicare (Part A and Part B) and may also offer coverage for things like dental, vision, hearing, and prescription drugs.

These plans let you combine hospital and medical insurance under a single plan. Some are designed to meet the needs of people with chronic health conditions, while others include features like wellness incentives or fitness access.

How Does a Medicare Advantage Plan Work?

Once enrolled, your Medicare Advantage plan becomes your primary insurer. You remain in the Medicare program, but the plan handles your benefits. Even if you enroll in a Medicare Advantage plan, you must continue to pay your Medicare Part B premium, unless your plan covers it on your behalf.

Most Medicare Advantage plans include:

- Hospital insurance (Part A)

- Medical insurance (Part B)

- Often, prescription drug coverage (Part D)

- Additional benefits such as transportation, over-the-counter item coverage and routine podiatry

Many plans use networks. You may need to choose doctors or clinics that are in the plan network to receive full coverage. Some plans offer flexibility to see out-of-network providers, but at a higher cost. Use our provider finder tool to search by location or specialty.

What Does Medicare Advantage Cover That Original Medicare Doesn’t?

Original Medicare doesn’t cover routine dental cleanings, eye exams, or hearing aids. It also doesn’t include prescription drug coverage or offer any out-of-pocket limit. Medicare Advantage plans often fill these gaps.

These plans may include:

- Routine dental, vision, and hearing care

- Prescription drug coverage

- Transportation to medical appointments

- Fitness programs

- Over-the-counter benefits for items like vitamins or pain relief

- Home health support or telehealth access

For example, someone recovering from a hospital stay might benefit from in-home support services that prevent readmission. Another person might choose a plan with a built-in fitness membership or OTC allowance to help with everyday wellness. Medicare Advantage plans give you the ability to find a plan that matches how you live and what you need.

Who Is Eligible for Medicare Advantage?

You can join a Medicare Advantage plan if:

- You have Medicare Part A and Part B

- You live in the plan’s covered service area

- You don’t have End-Stage Renal Disease (ESRD), with some exceptions

- You meet any other qualifications the plan may have

Enrollment periods include:

- Initial enrollment period: Starts three months before you turn 65 and ends three months after

- Annual enrollment period: Held every year from October 15 through December 7

- Special enrollment periods: Triggered by specific events such as moving to a new area, losing coverage, or qualifying for Medicaid

- Rolling enrollment: Available year-round for individuals who qualify due to special circumstances or meet eligibility criteria such as Medicaid enrollment or certain chronic conditions.

In general, you must be enrolled in both Medicare Parts A and B before joining a Medicare Advantage plan. If you’re unsure about the timing or how changes in your life affect eligibility, Align Senior Care can help guide you through the process.

Comparing Medicare Advantage Plans

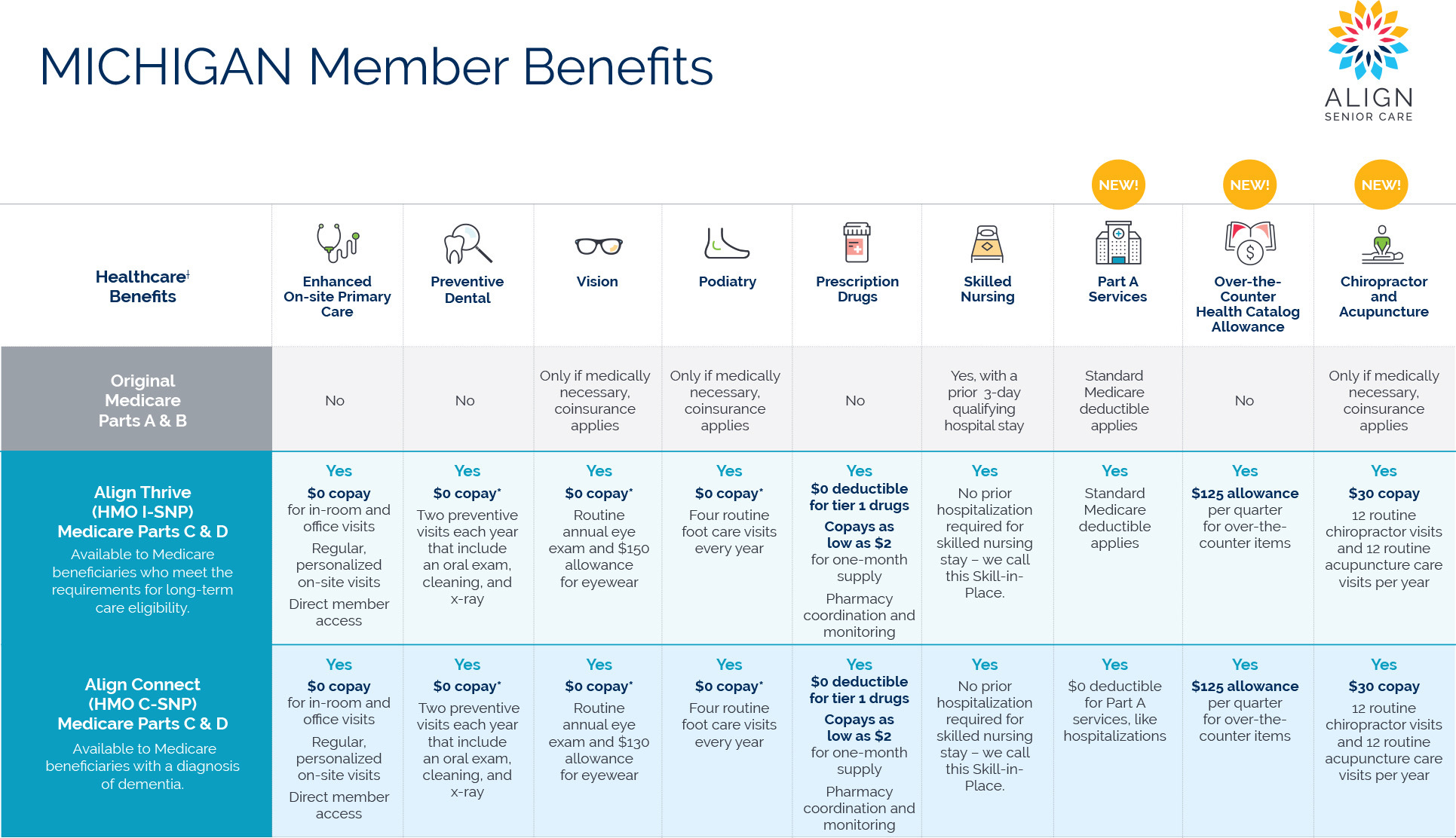

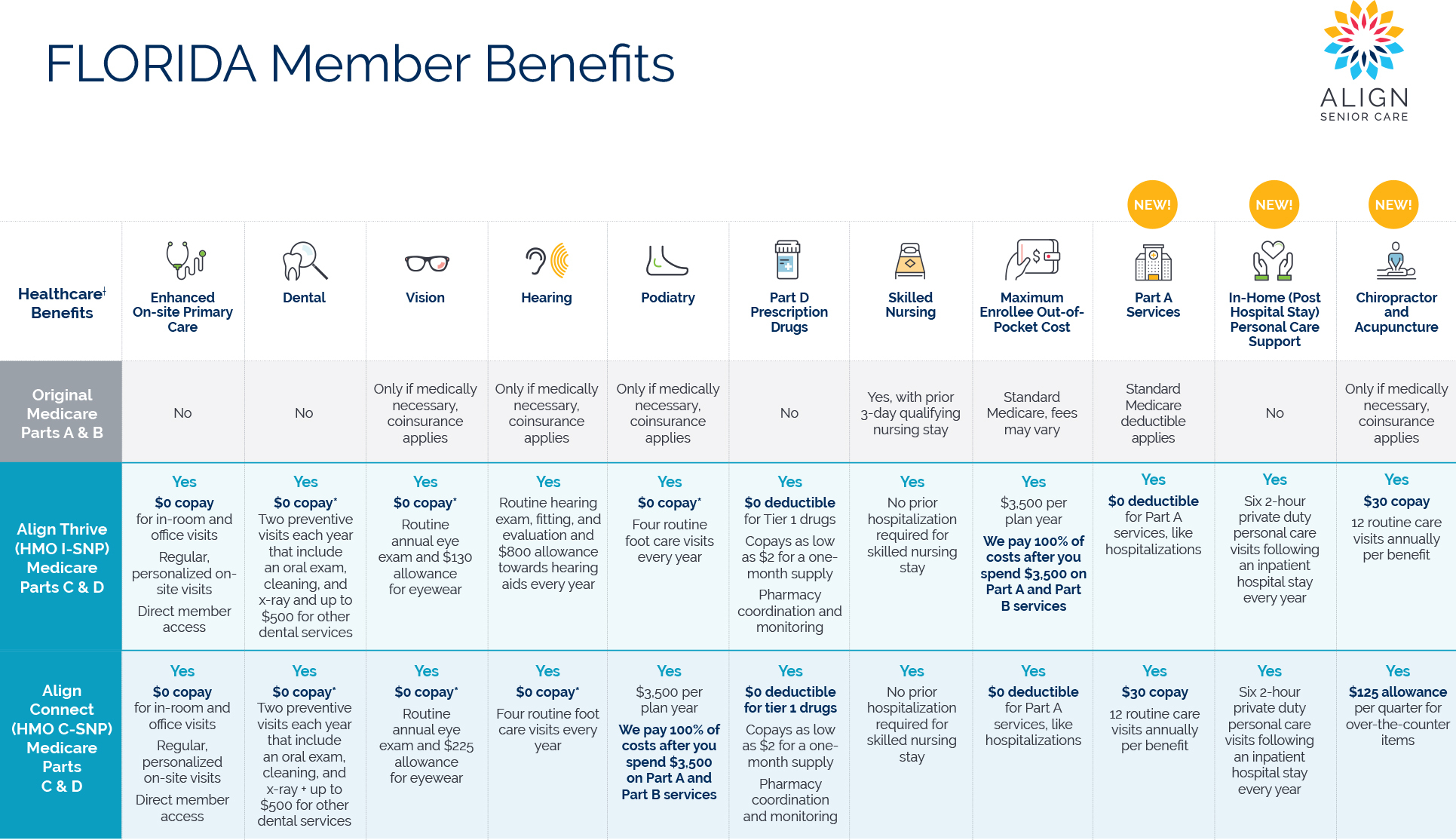

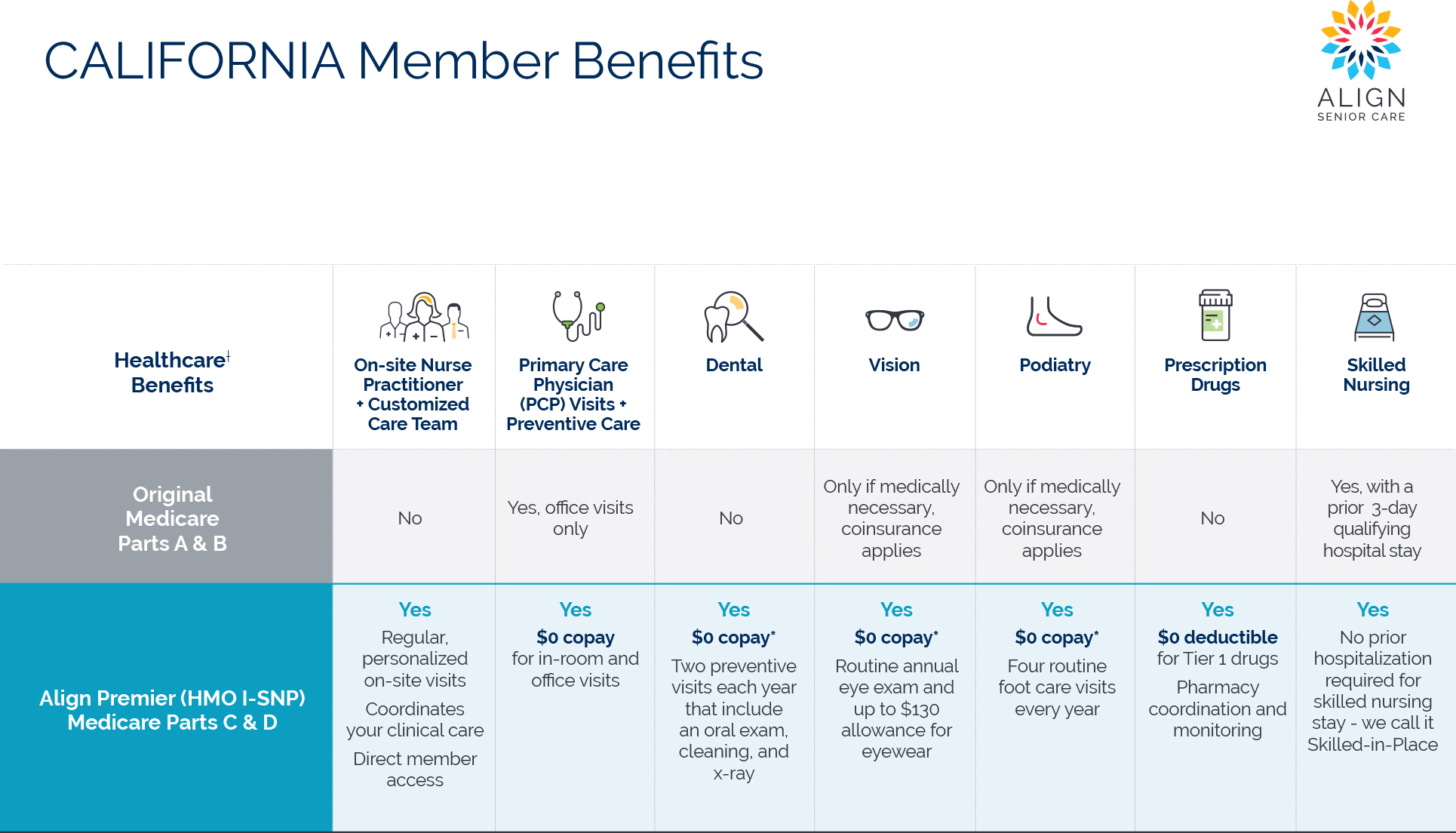

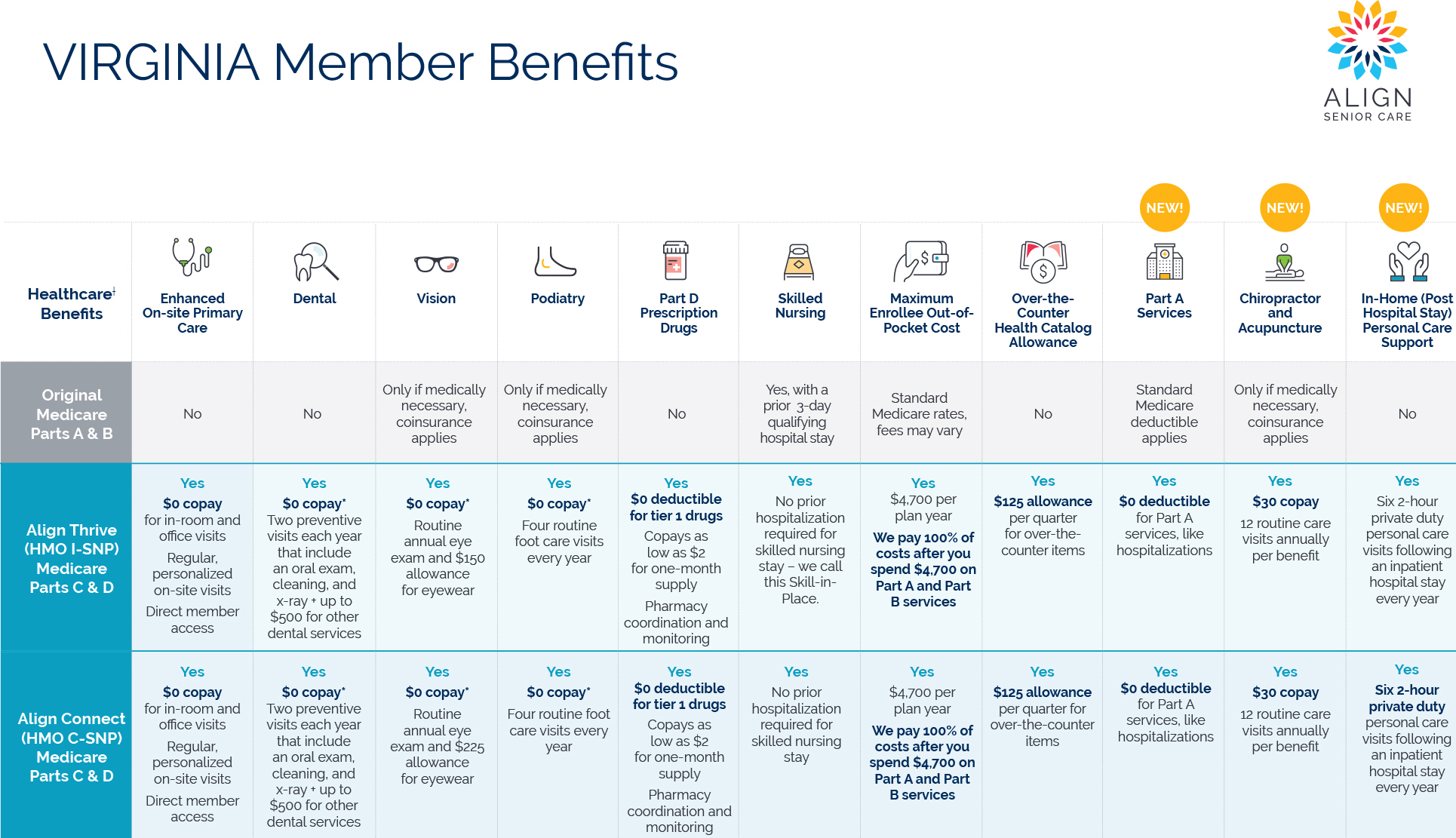

Not all Medicare Advantage plans offer the same structure or benefits. Some plans have $0 monthly premiums, but higher out-of-pocket costs. Others may focus on added extras like dental, fitness, or caregiver support.

It’s also worth checking how a plan handles prescription drug coverage. Many include it automatically, but the list of covered medications—called a formulary—varies. You’ll also want to confirm which doctors and hospitals are in the network, since most plans require you to use in-network providers to keep your costs low.

Comparing plans can help you avoid surprises later. You can view plan benefits through our healthcare plan documents.

Why Seniors Choose Medicare Advantage

Many older adults like the simplicity of Medicare Advantage. They prefer having one plan for hospital, medical, and drug coverage. Others choose Advantage plans for financial protection. Original Medicare doesn’t include an out-of-pocket maximum, but Medicare Advantage does. The extra services—like hearing exams, fitness benefits, or over-the-counter items—can also reduce costs and improve convenience.

For people managing multiple conditions, having one plan that includes care coordination, transportation, and preventive services can lead to fewer missed appointments and better long-term outcomes.

How Align Senior Care Supports Medicare Advantage Members

Align Senior Care offers Medicare Advantage plans designed for people living in long-term care and senior living communities. These settings come with unique care needs that require more coordination and more consistent support.

Our plans include medical care, behavioral health, preventive services, and prescription drug coverage. Members also get help with appointment scheduling, care transitions, and navigating their benefits. Because our team works within the communities we serve, we can provide timely support and adjust care quickly when needs change.

We also coordinate with the staff and providers in the community. That shared communication makes it easier to resolve issues, avoid delays, and create a better experience for members and their families.

Ready to Enroll or Compare Plans?

Medicare Advantage plans combine hospital, medical, and often prescription drug coverage under one plan. They may also include coverage for services not covered by Original Medicare. If you’re looking for coordinated care, added benefits, and coverage that fits your needs, a Medicare Advantage plan from Align Senior Care may be a fit for your needs.

An Align Senior Care Medicare Benefits Consultant can help you:

- Understand eligibility

- Compare plan benefits

- Enroll with support

- Coordinate care once your plan starts

Use our shop plans page to see what’s included. Schedule an appointment to speak with someone today!

Recent Comments