As you get closer to retirement, choosing a healthcare plan becomes a central part of planning ahead. For many, the question comes down to this: stick with private insurance or enroll in Medicare?

Both options offer coverage, but the structure, cost, and flexibility can be very different. This breakdown covers what you need to know about private insurance vs. Medicare, especially if you’re reviewing your current senior health plan or getting ready to make a change.

What’s the Difference Between Medicare and Private Insurance?

Medicare is a federal health insurance program for people aged 65 and older, for some people under 65 with certain disabilities, and anyone at any age with end-stage renal disease or ALS. It includes different parts (A, B, C, and D), which cover hospital care, medical services, drug coverage, and more. You can enroll in Original Medicare, a Medicare Supplement, or choose a Medicare Advantage plan through a private company.

Private insurance, on the other hand, is typically obtained through an employer, a spouse’s employer, or purchased directly through a health insurance marketplace. These plans can include individual, family, or group coverage—and often cover dependents.

The biggest difference is that Medicare is an individual plan, while private insurance may be part of a group plan that includes other people in your household.

Comparing Costs and Coverage

Cost is one of the most important considerations. While private insurance may be subsidized by an employer, it often comes with higher monthly premiums, especially for individual plans bought without employer support.

Medicare costs vary based on your work history and income, but most people don’t pay a premium for Part A. However, there are still deductibles, coinsurance, and monthly premiums for Part B, Part D, or a Medicare Advantage plan.

Here’s a general breakdown of cost differences:

- Private insurance: Higher monthly premiums, but may cover dependents and offer broader provider networks

- Medicare: Lower base costs, but more out-of-pocket responsibility unless you add supplemental or Advantage coverage

- Medicare Advantage: These plans include a maximum limit for out-of-pocket costs. Original Medicare does not

- Drug coverage: Included in most private plans. Medicare requires a separate Part D plan unless bundled in Advantage

It’s important to review your expected healthcare needs to determine which structure is a better financial fit.

Can I Have Both?

Yes, in some cases. It’s possible to have Medicare and private insurance at the same time, especially if you’re still working or covered by a spouse’s employer plan.

When you have both, one becomes the primary payer and the other pays second. For example, if your employer has fewer than 20 employees, Medicare may pay first. If your employer is larger, the private plan might pay first.

If you’re retiring and considering switching fully to Medicare, be sure to check whether that means losing access to employer-sponsored benefits or spousal coverage. Timing matters, and missing an enrollment window can result in penalties.

Choosing the Best Insurance Option for Your Needs

There’s no universal answer to which plan is better. It depends on your budget, your current healthcare providers, and whether you want or need coverage for a spouse or dependent.

Some older adults stick with employer-sponsored coverage until they retire fully. Others switch to Medicare right away for lower premiums and a simpler plan structure. And many choose a Medicare Advantage plan, which offers built-in extras like drug coverage, dental, or transportation services.

Here are a few reasons people make the switch to Medicare:

- They no longer need dependent coverage

- Their private plan costs are increasing

- They want a more predictable cost structure

- They prefer plans tailored to senior healthcare needs

If you’re looking for coverage that focuses on preventive care, wellness benefits, and simpler plan administration, a Medicare Advantage plan can be a strong fit.

How Align Senior Care Can Help

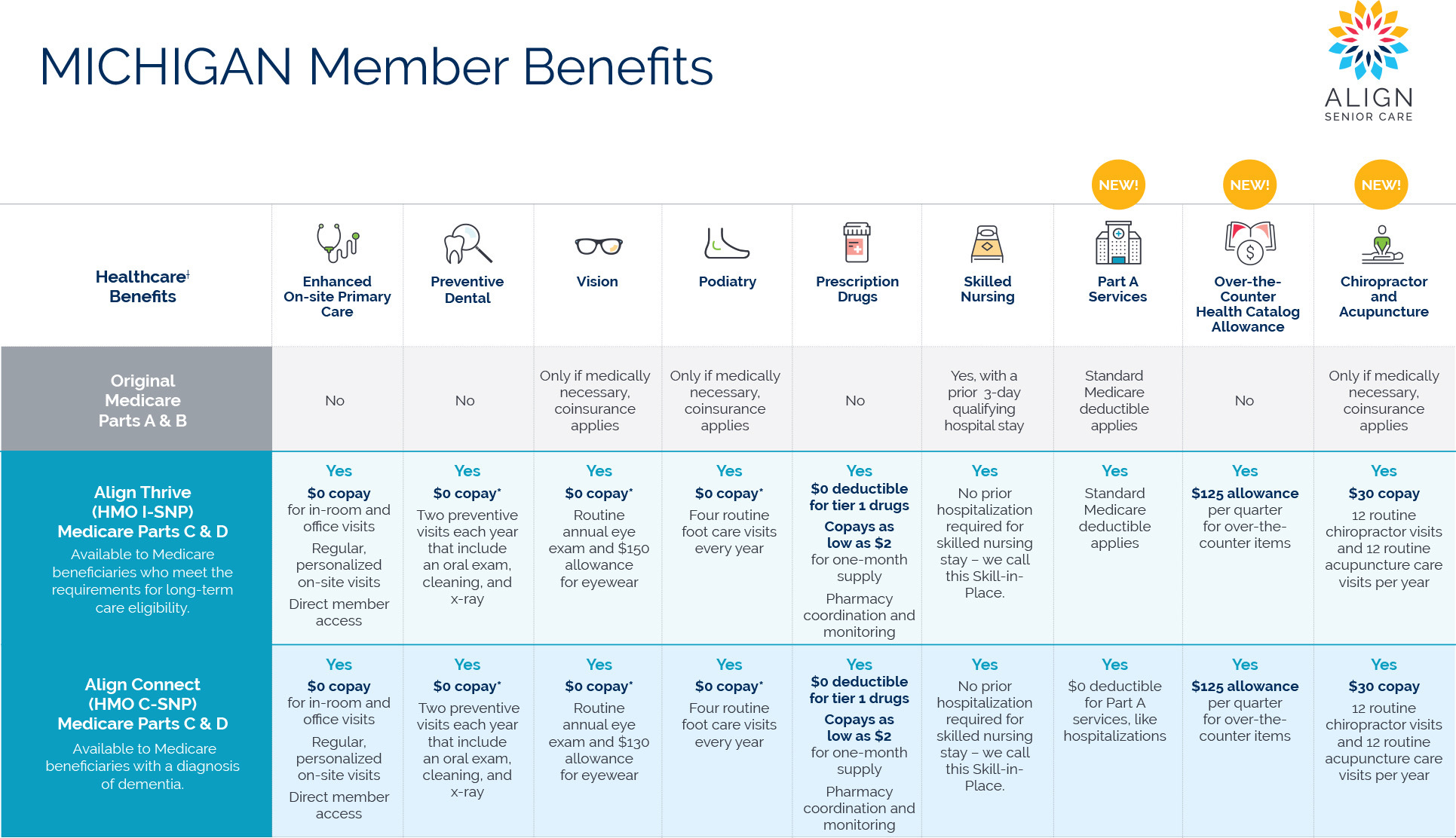

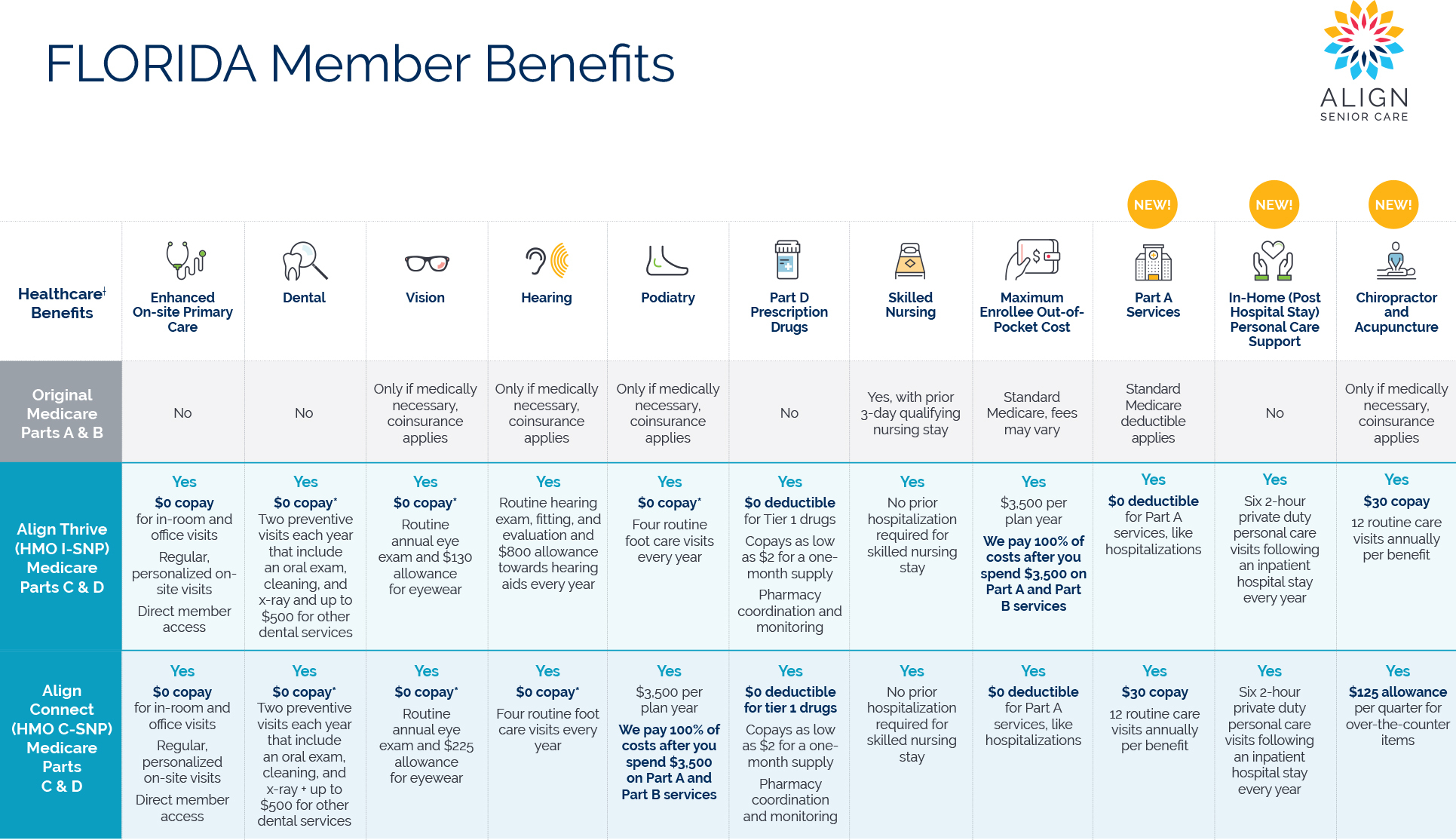

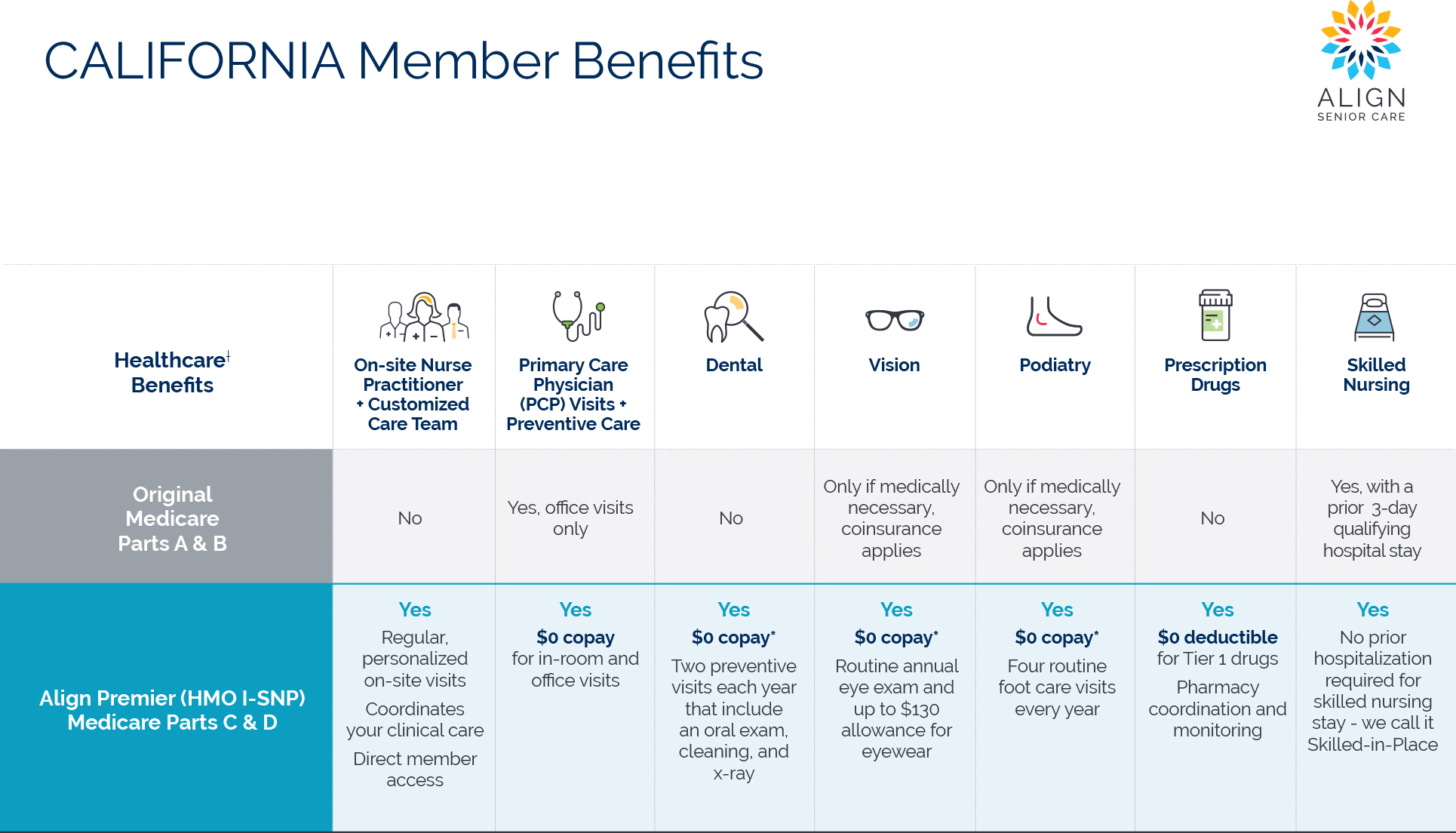

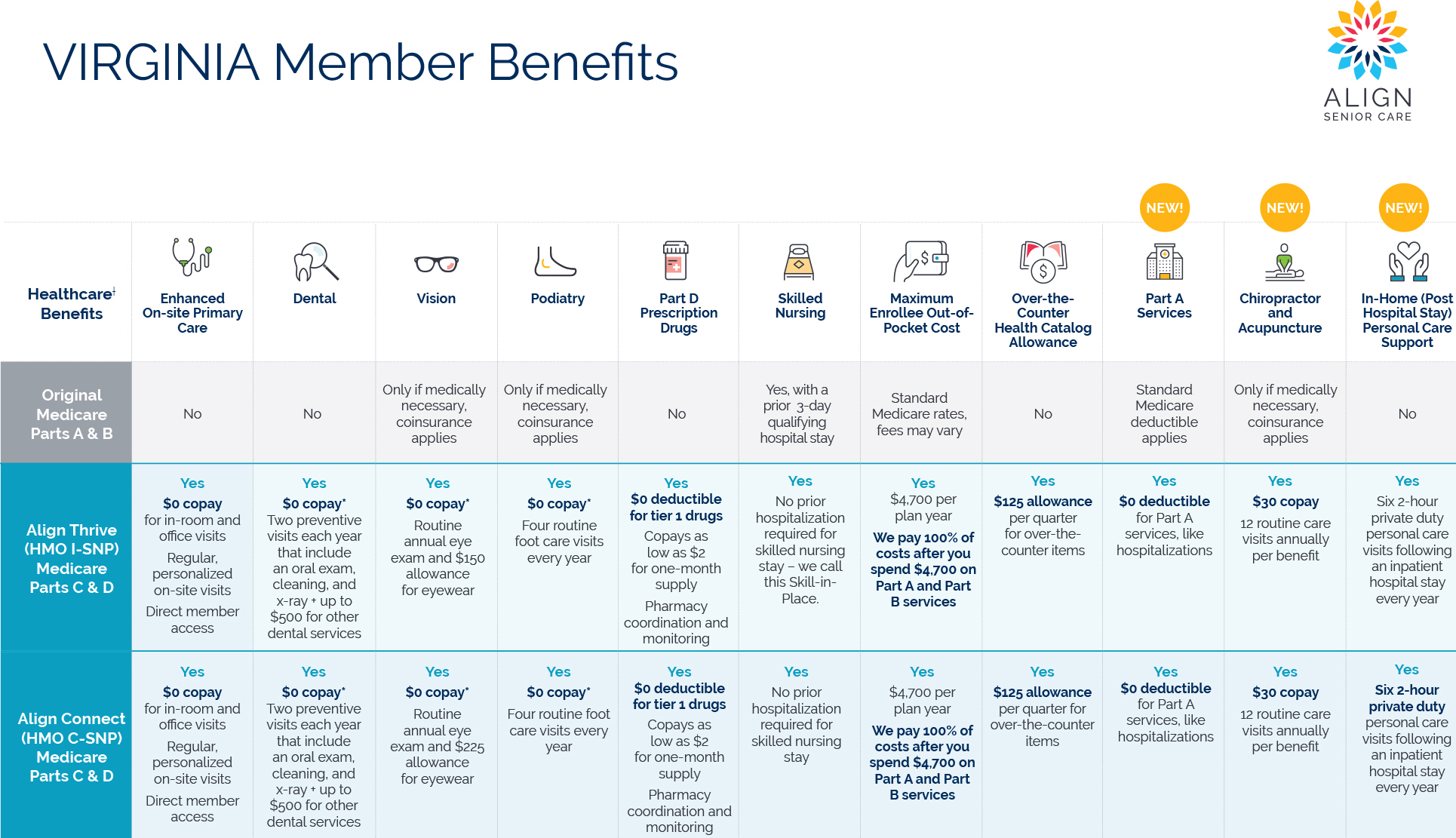

Align Senior Care offers health plans designed for people living in long-term care or assisted living communities. Our Medicare Advantage plans include medical care, behavioral health, preventive services, and prescription drug coverage. Members also get help with appointment scheduling, care transitions, and navigating their benefits. Because we work directly with care teams and community staff, our plans help members access services without unnecessary delays or confusion.

When to Review or Switch Plans

Review your healthcare coverage if:

- You’re turning 65 soon

- You’re planning to retire within the year

- Your existing premiums or out-of-pocket costs have gone up

- Your health needs have changed significantly

- You’ve moved to a new state or service area

Even if you’re satisfied with your current plan, it’s worth comparing benefits once a year during Medicare’s Annual Enrollment Period.

Recent Comments